Promotion of the Audit Findings

The Board explains the contents of the Audit Report to the Diet and other financial authorities to ensure that audit results will be properly reflected in future budget compilation and execution.

(1) Submission and Explanation of the Audit Report to the Diet

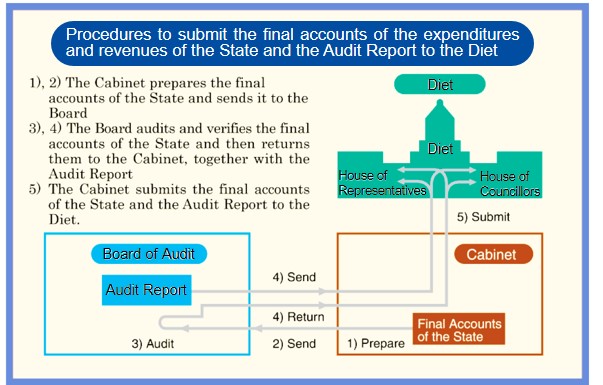

The Audit Report is submitted, with the final accounts of the expenditures and revenues of the State, through the Cabinet to the Diet for deliberation of the Stateʼs final accounts.

Deliberation on the State’s final accounts is held by the Committee on Audit and Oversight of Administration in the House of Representatives and Committee on Audit in the House of Councillors. The effectiveness of the audit can be fully achieved only when the Audit Report is sufficiently utilized in the Diet, which is the representative organ of the public, and when investigation into causes and measures for improvement in respect to matters incorporated in the Annual Report are thoroughly realized.

Senior officials of the Board always attend the above-mentioned deliberations of the Committees to explain the contents of the Audit Report or relevant audit activities, and to present the Board’s opinion. As such, the Audit Report is an essential document for deliberations in these Committees.

Senior officials of the Board also attend the Committees on Budget and other Diet Committees to explain the contents of the Audit Report or to express the Board’s opinions as required.

In preparing the audit plan and implementing its audits, the Board fully takes into consideration requests from the Diet and deliberations in order to respond to the expectations of the Diet and the public.

(2) Explanation to financial authorities

The Board holds regular meetings with the Budget Bureau and Financial Bureau of the Ministry of Finance to provide explanations of the findings in the Audit Report and to express opinions on items of interest discovered during the audit to serve as sources of reference for budget compilation and financial administration.

At these meetings, the Board hears, in return, the background and intention of the budget compilation and points to be noted in budget execution by the financial authorities for reference toward the audit.

<Training Courses for Auditees>

In order to enhance and reinforce auditees’ internal audit and internal check systems, and to prevent recurrence of the audit findings, the Board organizes the following training courses and briefings.

The internal audit of each ministry and agency is expected to work efficiently for appropriate budget execution together with the external audit by the Board.

(1) Briefing on the Audit Report

The Board conducts briefing sessions on the Audit Report for (1) deputy vice-ministers of all ministries, (2) senior directors of accounts divisions of all ministries, (3) relevant accounting officers of all ministries, (4) auditors and board members in charge of budget execution of State-owned enterprises, and (5) prefectural accounting managers.

At this briefing, officials of the Board explain audit findings in detail for better auditee understanding and prevention of recurrence of the reported findings.

(2) Training courses for auditee personnel

In order to contribute to the improvement in accounting and audit capability of auditee officials, the Board organizes the following training courses for accounting officials and internal auditors of all ministries and agencies, incorporated administrative agencies and local governments on accounting practices and relevant laws and regulations, as well as audit techniques.

- ・Courses for Internal Auditors of Ministries and Agencies

- ・Courses for Internal Auditors of State-owned enterprises

- ・Course for Accounting Officials of Prefectural Governments

- ・Courses for Internal Auditors of Local Governments

- ・Courses for Internal Auditors of Prefectural Governments (General Audit Courses and Construction Audit Courses)

The Board also dispatches staff members as lecturers to the training courses organized by auditees such as ministries, agencies and local governments for prevention of recurrence of the audit findings on the condition that the dispatched lecturer does not hinder his/her audit activities.

(3) Internal audit related services

The Board conducts researches and analyses on auditees’ internal control such as the status of internal audits and internal check systems etc., and has meetings with officials in charge of internal audit in ministries, agencies and so on in order to promote improvement and strengthening of internal audits.